The Generation Rent suggests that the most popular insurance-backed schemes should be abolished, forcing all tenants to protect deposits by applying for custodial schemes that could be viewed from a mobile application. Additionally, this application would allow them to transfer a part of their deposit to their new home, once they’d paid their last month’s rent on their current property.

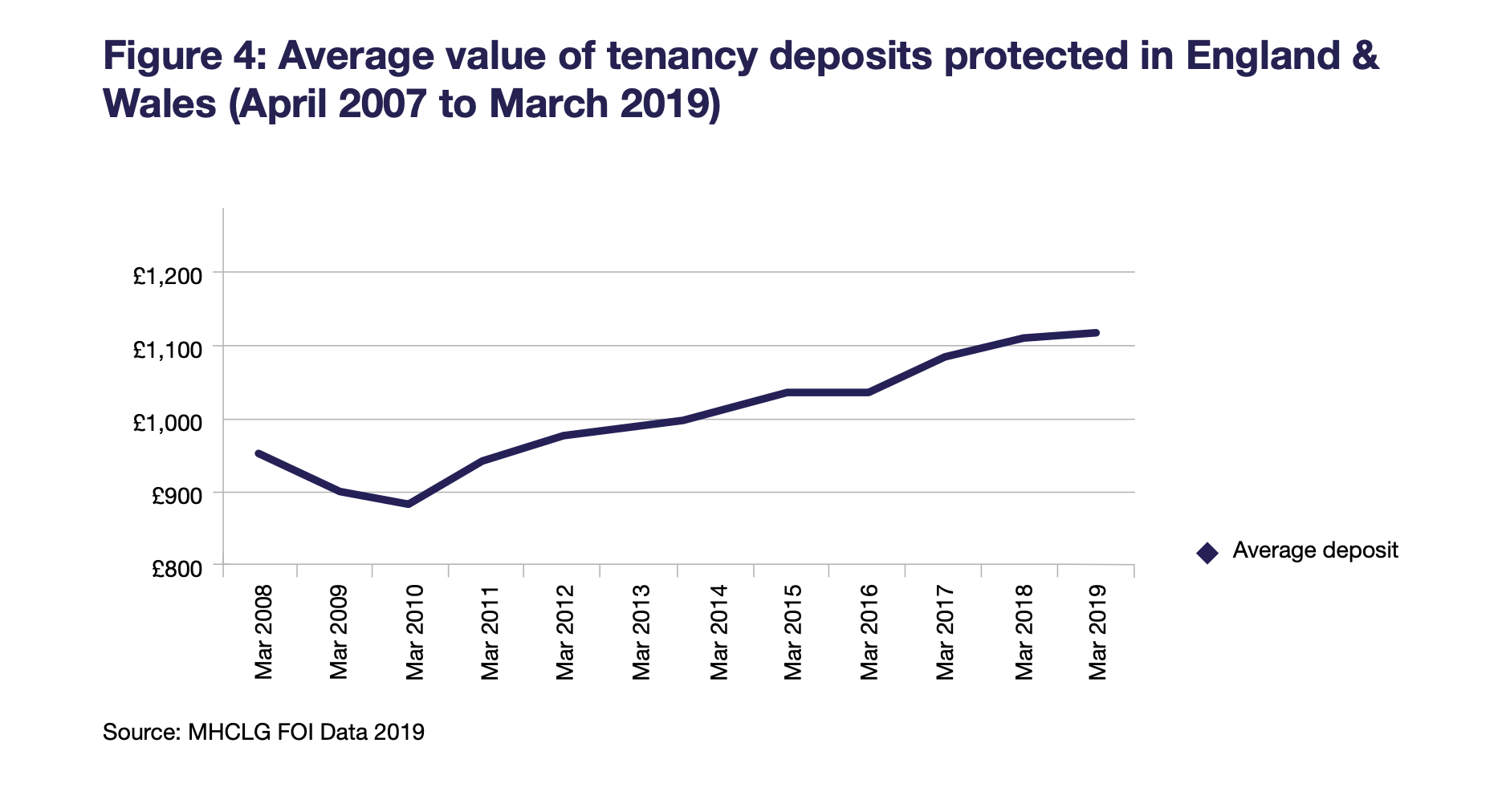

This is a fabulous idea, as it is financially difficult to be a tenant in the UK, where some properties require a huge proportion of a salary to be stored for a reallocation. The deposits usually range from two to five weeks, making the renting process more expensive than it should be. For the record, the average value of tenancy deposits has risen since 2008 and reached a new high of £1,108.

Additionally, this money is fixed for a year and no interest is being paid. Following the research conducted by Generation Rent, tenants are losing out on more than £80m a year in interest on the £4bn of their money held as deposits. This is despite government guidance for schemes to start distributing interest.